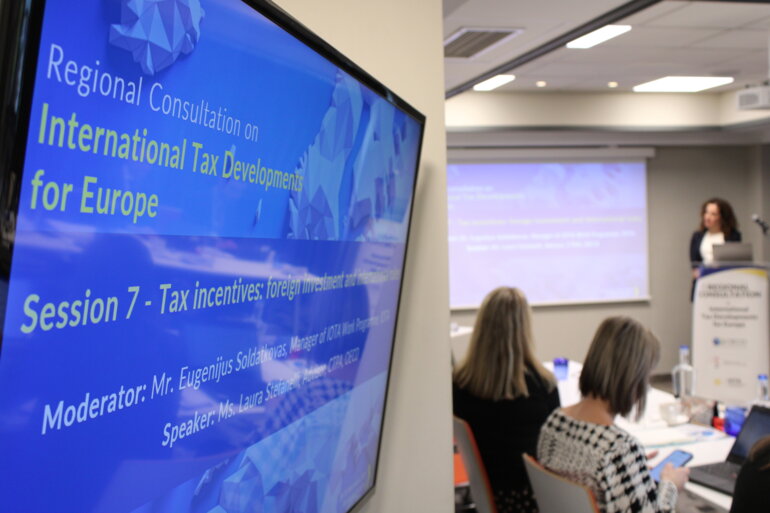

Main activity

IOTA’s main activity is organising workshops and forum meetings offering participants from various member tax administrations the opportunity to share their views and experiences and develop best practices with the aim of improving its members’ tax administrations. IOTA also delivers practical and applicable publications for its members and promotes cooperation both between its members as well as with other international and regional organisations.